The best trading platforms for beginners in September 2024

5% for other cryptos Kraken Instant Buy. Once the momentum dies down, it’s time to sell. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. Many people have downloaded its latest version, and everyone has described it as attractive. The best way to learn position trading is to analyze past data and derive patterns. You should consider the appropriateness of the information having regard to your personal circumstances before making any investment decisions. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, 125 S. In the second example, the long term MA is declining, so we look for short positions when the price crosses below the five period MA, which has already crossed below the 20 period MA. Notifications that the disclosure of inside information has been delayed shall immediately be submitted to FI by e mailing after the insider information has been published. Different trading strategies also consider factors po-broker-in.site such as risk tolerance, market trends, technical indicators, and fundamental analysis. BSE, NSE, and MCX, which makes it a superb option. Discover our 13,000+ CFD markets to trade. Learn more about our services for non U. Trading fees: 1% spread. Reddit and its partners use cookies and similar technologies to provide you with a better experience. See how we rate products and services to help you make smart decisions with your money. Another key tip to keep in mind is developing financial literacy and knowing the trading terms and market jargon used. Spotlight Stock Market and Nordic MTF shall inform the public as soon as possible about inside information that directly affects that issuer. Get the 5 minute AI news brief keeping 150k+ readers in the loop. But now the portal is not working. Even non native developers can create powerful and intricate algorithms. Trending Blogs: Invest in Small Cap and Mid Cap Mutual Fund and Stocks US FED’s rate cut announcements Companies affected by Rise in Crude Oil Price Fall in IT Stocks Launch of 4 New Indices Revised Lot Sie of Nifty Contracts RBI Monetary Policy Committee Meet 2024 ITC Share Surge After BATs Block Deal.

Where are the good US Forex Brokers?

It all comes in a customizable layout, or you can opt for one of the preset layouts. If your goal is to create a diverse portfolio of individual stocks without a large upfront capital commitment, be sure the broker you choose has both of these features. A good intraday trading strategy works only after technical analysis, practical execution, using indicators and proper risk management. Research analyst or his/her relative or Bajaj Financial Securities Limited’s associates may have financial interest in the subject company. Good luck out there, we’re rooting for you. Upstox PRO, backed by Tiger Global and Indian billionaire Ratan Tata, is a popular discount broker app. NMLS Consumer Access Licenses and Disclosures. In other words, the seller must either sell shares from their portfolio holdings or buy the stock at the prevailing market price to sell to the call option buyer. Specific Commodity Trading Time/Hours. Then you should choose the right broker. Moneybhai is an investing simulation game. Stock prices are based on expectations of future profitability, with the value of any individual stock being a function of supply and demand. So whether you are a forex, cryptocurrency, or stock trader, you can get in depth study resources on these platforms. The reader bears responsibility for his/her own investment research and decisions. Account opening charges.

Pros and Cons of Trading Options

Blueberry Markets V Ltd is regulated by Vanuatu Financial Services Commission Company number: 700697 holding License Classes A, B and C under the Financial Dealers Licensing Act. They involve identifying the direction of the market trend and making trades in the same direction, with the intention of capturing momentum swings within that trend. As markets evolve, so do strategies, risks, and opportunities. Prices going to either of the extremes may mean a revert, and therefore, a reversal strategy is in place for scalping. You can access the software on Windows, Mac, iOS, and Android devices, and the company states that it covers 100% of your deposits up to $1,000. This reduces the risks of losing all your money on one or a series of bad trades while you’re still learning. Clients can access 2,000+ markets, including CFDs on forex pairs, indices, commodities, ETFs, stocks, and cryptocurrencies. 575% on balances below $25,000, as of June 2024. Com and thinkorswim®. This could end up being an expensive mistake.

What is quantitative trading?

Bajaj Financial Securities Limited is not a registered broker dealer under the U. A mobile app user can chat live with a trading specialist and even share their screen without leaving the app. But if I hold too strong and I’m wrong, I’m in for heavy losses. This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. Like paper trading, backtesting offers both beginner and experienced traders a way to test their strategies. A trinomial tree option pricing model can be shown to be a simplified application of the explicit finite difference method. If FI does not consent to delaying the disclosure, the issuer shall disclose the inside information immediately. Traders may choose to focus on short term timeframes, such as 5 minute or 15 minute charts, for quick and frequent trades, or they may opt for longer timeframes, such as 1 hour or daily charts, for more extended positions.

Limited budget?

When you trade options with us CFDs to speculate on the option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes. Posts announcing products or services are not allowed. That said, price action has a greater significance in the case of a scalping strategy. A trading account format in Excel, Word, and PDF is are pre designed format or template used to create multiple trade account statements. You will get many high quality features, which I found very attractive. Create profiles to personalise content. While position traders may execute trades as quickly as a few weeks, this style typically entails a longer holding period. When the MACD is above zero, the price is in an upward phase. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The following are several basic trading strategies by which day traders attempt to make profits. So unlike the stock or bond markets, the forex market does NOT close at the end of each business day. Target bear” in the stock market usually refers to a market condition where prices are expected to fall, leading to a downward trend or bearish sentiment. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. At about the same time, portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black–Scholes option pricing model. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. All digital asset transactions occur on the Paxos Trust Company exchange. Step 1: Develop a Business Plan. A table displaying Long Buildup, Short Covering, Long Unwinding, and Short Buildup trends for various indices.

“accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture” allowfullscreen>

How swing trading differs from day trading and long term investing

There must be clearly defined policies and procedures to monitor the position against the firm’s trading strategy including the monitoring of turnover and stale position in the firm’s trading book; and. This article focuses on a daily chart, wherein each candlestick details a single day’s trading. Measure advertising performance. The trader executes hundreds of trades in a single day. Measure content performance. A long legged doji pattern resembles the indecision between the market participants. However, the majority of individuals who are interested in trading do not really have a trading technique that works, despite the fact that they feel they have. Christopher Vecchio, DailyFX currency strategist. Investors participating in this special trading session should keep a few things in mind. If you’re committed and hard working, it’s an exciting profession that can offer a fulfilling career.

Subscribe to The Real Trader Newsletter

Trading is straightforward but sometimes people ain’t aware of successful trading business ideas resulting in a failed business. Eastern time on non holiday weekdays. By diligently applying these practices and harnessing the power of detailed technical analysis, traders are better positioned to navigate the markets with confidence and exploit the opportunities presented by bearish reversals. The double top or bottom are reversal patterns, signaling areas where the market has made two unsuccessful attempts to break through a support or resistance level. For example, assume an investor is long a call option with a delta of 0. You can create strategies with only. Are used my savings of 10 grand to invest in stocks on Robin Hood. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners. Do not get it wrong; you can use the patterns independent of other indicators – however, working with other indicators verifies your approaches and reduce risk/fakeouts. This comes with a trader specific caveat, as many desktop platforms intended for active traders have to cut out a lot more when transitioning to mobile when compared to brokerages with platforms aimed at average investors. Win or lose, sell out. Similar to support and resistance trading, a breakout trader will usually open a long position after the stock price breaks above the resistance level, or will enter a short position after the stock falls below the support level. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024. Prefer to do your research on premise. Learning how to trade any market can seem daunting, so we’ve broken forex trading down into some simple steps to help you get started. Suppose someone expects a particular stock to experience large price fluctuations following an earnings announcement on Jan. Start trading over 70 US markets out of hours with IG. Investors participating in this special trading session should keep a few things in mind. Use strong passwords, enable two factor authentication 2FA if available, and regularly monitor your account for any suspicious activity. In fact, if you trade a demo account for extensive periods of time, it can backfire and hurt your trading career later on. This creates a stark contrast in how these two trading styles operate. A registered broker dealer and member FINRA/SIPC. Intraday traders generally prefer the early morning market hours due to the high volatility and liquidity. First and foremost, to get a better understanding of how you can kickstart your trading journey, it is important to know what trading actually means. Sideways/Low Volatility: Repeatedly selling Puts or Calls to generate income can accumulate profits over time. Read more about call options. They identify entry and exit points using them. This indicator is valuable in identifying potential trading opportunities based on these overbought and oversold conditions.

Market Snapshot

Thank you for any help you can provide, I am so afraid to make a mistake : I have held off doing anything for too longHave a great day. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. Due to the wide range of market participants, including central banks, financial institutions, corporations, hedge funds, and individual traders, exchange rates change by the second so the market is constantly in flux. When the put volume is higher than the call volume, the ratio is less than 1, indicating bearishness. Finally, Wealthfront and Acorns are both award winning robo advisor platforms. Stockbrokers charge nominal fees while transacting in intraday trading stocks, as delivery expenses of transferring security in the name of an investor are forgone. Live account holders can also access MetaTrader 4 and ProRealTime platforms, which offer advanced capabilities like automated trading. For example, say a day trader has completed a technical analysis of a company called Intuitive Sciences Inc. These algorithms can be as simple as using moving averages to predict the next price action. In this sense, the call options provide the investor with a way to leverage their position by increasing their buying power.

Indian Equities

Studies also show that day traders’ earnings are marked by extreme variability. Also fair game for thinkorswim customers: ETFs that invest in cryptocurrency futures and in the stock of companies whose businesses are related to crypto, such as crypto mining companies and exchanges. Lo, Harry Mamaysky, and Jiang Wang, published in The Journal of Finance, the success rate attributed of three inside up pattern was approximately 64% in predicting bullish reversals. Options are financial contracts that offer you the right, but not the obligation, to buy or sell an underlying asset when its price moves beyond a certain price within a set time period. With engaging gameplay, social connectivity features, and user friendly interface, Color Trading App offers a fun and engaging gaming experience for players of all levels. Assume that you bought GMR futures by paying margin of 15%. Option traders utilize various types of trading indicators for options trading. Rounding bottom patterns will typically occur at the end of an extended bearish trend. Access our full range of markets, trading tools and features. Support and Resistance: Support is a price level where buying tends to occur, and is the lowest price of an asset in a time period. Charles Schwab presents a highly functional mobile app that is intuitive and capable and appeals to traders with a range of experience. Advertiser Disclosure: ForexBrokers. We have not established any official presence on Line messaging platform. INR 0 brokerage for life. Scalping is a trading style that specializes in profiting off small price changes and making a fast profit off reselling. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Meet 15 traders who’ve consistently beaten the markets. Cryptocurrency holdings may be transferred off the platform. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. It comes with a periodic interest rate that the investor must pay to keep it active. Your Mobile number and Email id will not be published. Closing session close time: 12:50 p. These best indicator for options trading helps traders understand the range in which the market is moving, in which direction it is going, and the duration of that move. I am using an iphone7 and the app is loading too slow. After all, there are traders who trade simply with squiggly lines on a chart. Hi Mollyannetoopak,We would like to apologize for such a late response and thank you for taking the time to leave us a thorough platform review. WHAT IS YOUR REASON FOR ENQUIRING. © 2024 Florida International University Website by Digital Communications Website Feedback Web/Accessibility Sitemap.

Paper Trading Made Easy and Effective

Here are the top brokers to help you trade global markets. Time decay is referred to in trading parlance as theta. A profit and loss PandL statement is one of the three types of financial statements prepared by companies. Use profiles to select personalised advertising. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. For more information, please see our Cookie Notice and our Privacy Policy. Some traders believe that this sequence confirms a reversal. Though most of these forex trading apps can usually be downloaded free of charge on all the popular platforms available today, always be on the lookout for important functionalities and features in selecting your choice of forex trading app. You could also set two stop loss orders. 19 to March 19, 2024. What Percent Of Your Income Can Go For Mutual Funds.

A 6 Step Guide to a Safe and Secure Healthcare App Development

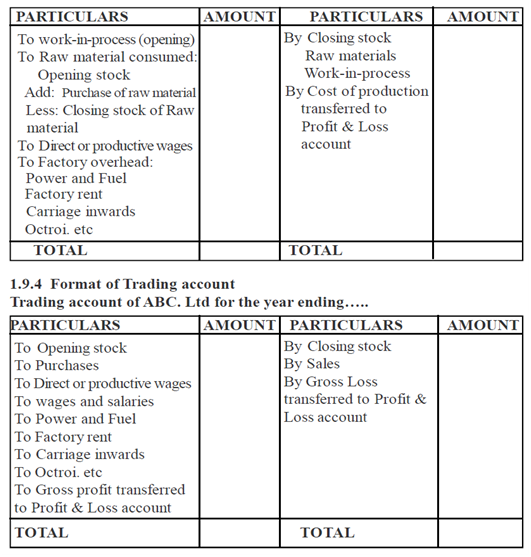

This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. In case of any grievances, please write to Special Administrative Region of the People’s Republic of China Account would be opened after all procedure relating to IPV and client due diligence is completed. It serves as a repository for stocks, bonds, mutual funds, and other financial instruments, eliminating the need for physical share certificates. For the following question, prepare a trading account. This example demonstrates the power of pattern recognition in predicting price reversals and securing profitable outcomes. Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. You’re never going to be right nine times out of ten. For example, a company doing business in another country might use forex trading to insure against potential losses caused by fluctuations in the exchange rate. However, there are a few things to keep in mind when swing trading during bull markets. For instance, fear may prompt traders to abandon positions prematurely, while greed can lead to excessive risk taking. Telephone calls and online chat conversations may be recorded and monitored. Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. This strategy can be used by beginners to start trading. Benefits: i Effective Communication ii Speedy redressal of the grievances. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures.

Share Market

Appreciate Broking IFSC Private Limited is a registeredbroker dealer with IFSCA Registration No. Determining the best investment app depends on individual preferences and investing goals. Refer to the form below. You need to be honest about your risk tolerance, investment goals, and the time you can dedicate to this activity. FINRA defines pattern day traders as investors who satisfy the following two criteria. Bajaj Financial Securities Limited or its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Stick to the ones I mention in the article as they are very well known and regulated. A few things I wish could be better is the zoom on the charts could give a little more control, I feel like the Mt5 does a better job at this. While some accounts may have higher monetary requirements, accounts like the J. 60% of retail investor accounts lose money when trading CFDs with this provider. This means that a question naturally arises: what is the use of preparing a trading account. The trader might close the short position when the stock falls or when buying interest picks up. While partners may pay to provide offers or be featured, e. With more than 360 cryptocurrencies available, Binance. The profit and loss account provides information about an enterprise’s income and expenses, this results in the net profit or net loss, which helps a businessman to evaluate the performance of an enterprise and provides a basis for forecasting the future performance. Are there any other platforms out there with a modern user experience / ui that offer almost all of the same offerings that fidelity has or better. The MACD crossover swing trading system provides a simple way to identify opportunities to swing trade stocks. Margin interest rates are usually based on the broker’s call rate. To improve your confidence as a trader, you can practise using the $20,000 virtual funds in the risk free demo account environment.

NSE Group Companies

If you own an asset and want to protect it against potential downwards market movement, you could buy a put option on the asset. Traditionally, the TICK index is a technical analysis indicator that shows the difference in the number of stocks that are trading on an uptick vs a downtick in a particular period of time. A trinomial tree option pricing model can be shown to be a simplified application of the explicit finite difference method. A 50 day EMA is the most common and popular type of moving average to use, mainly because it’s long enough to filter out any short term noise but still offers a glimpse into near term price action. We apologize for any inconvenience caused while this page was under maintenance; it will be back up and better than ever as soon as possible. Fidelity is constantly adding new features to the app, and if you talk with stock market day traders, you will likely find that many of them enjoy the complex range of metrics the Fidelity app provides, such as heat maps and comparative charts. These troughs are linked by a peak which typically indicates a false resurgence, or a pullback, before a more profound bullish sentiment takes hold. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. While delivery trading can be an excellent long term investment option, intraday trading can fetch you returns within a single day. The most popular sentiments are known as reversal and continuation. By allowing them to automate their quant strategies and sell them to investors and traders the world over. Freetrade: Trading and Investing. 70% of retail client accounts lose money when trading CFDs, with this investment provider. This research report has been prepared and distributed byBajaj Financial Securities Limited in the capacity of a Research Analyst as per Regulation 221 of SEBI Research Analysts Regulations 2014 having SEBI Registration No. They restrict the loss a trader may sustain by automatically closing a deal when it hits a specified price. It shows the price bouncing off the support and resistance lines moving closer together as the market rises. So when the need arises, you can simply create a trade account format. A web browser application Managing all of your investments on a mobile app can be tricky. Investors tend to use a variety of strategies to maximise their gains in the stock market. How to Invest in Share Market. From my personal experience, AutoChartis can help to save a lot of time identifying technical analysis events in the market and could be a good addition to your trading. Bollinger bands typically come in three types: a middle band, one upper band, and one lower band. The data would be provided to the clients on an “as is” and “where is” basis, without any warranty. Confirmation often involves using other technical analysis tools and day trading patterns. Yes, you can actually buy and sell stocks without a broker, but it is not a common approach these days.